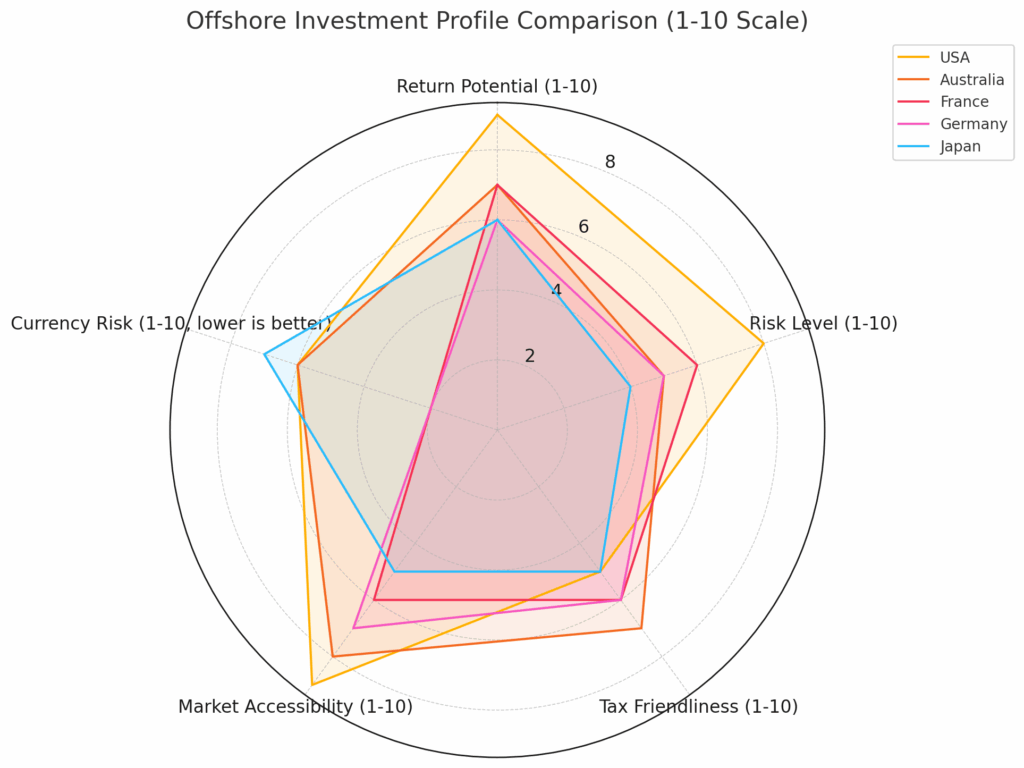

As global markets shift and diversify, Irish investors are increasingly looking offshore for stable, profitable investment opportunities. Whether seeking geographic diversification, exposure to new sectors, or hedging against domestic risks, investing abroad can offer both lucrative rewards and complex challenges. Here’s an analysis of five mature, globally significant markets—Australia, the USA, France, Germany, and Japan—and how they stack up for Irish investors in 2025.

1. United States

Why Invest: Market Depth, Innovation, and Liquidity

The United States remains one of the most popular offshore destinations for Irish investors due to its dynamic economy, robust capital markets, and culture of innovation. Tech, healthcare, green energy, and AI are booming sectors attracting foreign capital.

Key Advantages:

- Deep and liquid public markets (NYSE, NASDAQ)

- High-growth startups and established giants

- Strong legal protections for foreign investors

Considerations:

- Complex tax compliance, especially with IRS regulations like FATCA

- Currency risk (USD/EUR)

- Political gridlock can impact regulation and fiscal policy

Best For: Public equities, venture capital, REITs, and tech-sector exposure.

2. Australia

Why Invest: Resource Wealth and Stable Governance

Australia offers Irish investors a politically stable, resource-rich environment with a strong rule of law. It’s also in a strategic location for tapping into Asia-Pacific trade. Australia’s proximity to Asia rather than Europe also makes it one of the better offshore countries to invest in if you’re looking for diversity in an Irish heavy portfolio.

Key Advantages:

- Strong natural resource and mining sectors

- Growing renewable energy and infrastructure development

- Familiarity with English common law system

Considerations:

- Geographic distance can hinder operational investments

- Heavy sectoral exposure to commodities

- Relatively small market compared to the US or EU

Best For: Mining, real estate, infrastructure, and dividend-focused equities.

3. Germany

Why Invest: Europe’s Industrial Engine

Germany is the largest economy in Europe and a manufacturing powerhouse which is one of the reasons it’s often considered as one of the best offshore countries to invest in. For Irish investors seeking stability within the EU framework, Germany offers low political risk and high-quality infrastructure.

Key Advantages:

- Strong export economy with a skilled workforce

- EU-member state—no exchange rate risk for EUR investors

- Advanced manufacturing and automotive sectors

Considerations:

- Slower post-COVID growth compared to peers

- Regulatory complexity and high labor costs

- Less vibrant startup and tech culture than US or UK

Best For: Industrial equities, private equity, and green energy funds.

4. France

Why Invest: Innovation Meets Government Backing

France has quietly emerged as a startup-friendly hub, particularly in fintech and AI. French government incentives have spurred entrepreneurship, while the country remains a cultural and economic heavyweight in Europe.

Key Advantages:

- Proactive government support for innovation and R&D

- Excellent healthcare, luxury goods, and aerospace sectors

- Tax treaties with Ireland reduce double taxation risks

Considerations:

- Bureaucratic complexity and high payroll taxes

- Political volatility (e.g. pension reforms, strikes)

- Slower growth outside major urban hubs

Best For: Startups, luxury brands, aerospace, and green innovation funds.

5. Japan

Why Invest: Stability and Innovation in a Mature Market

Japan presents an interesting case—an aging population, but a leader in robotics, precision manufacturing, and advanced technologies. It’s a less volatile market with a long-term value investing appeal.

Key Advantages:

- Global leaders in technology and robotics

- Strong corporate governance reforms in recent years

- Low interest rates and monetary stability

Considerations:

- Language barrier and cultural differences can complicate direct investments

- Deflationary trends and demographic headwinds

- Currency risk (JPY/EUR)

Best For: Robotics and automation ETFs, dividend value stocks, and long-term equity holdings.

Each of these five countries offers distinct advantages for Irish investors, from the tech-fueled boom of the United States to the manufacturing strength of Germany and the innovation-led resurgence of France. As always, the best strategy is one that aligns with your risk tolerance, investment goals, and timeline—while ensuring full compliance with Irish tax regulations on offshore holdings.

For many Irish investors, a diversified international portfolio—balancing high-growth sectors with stable, dividend-yielding assets—can provide the best risk-adjusted returns over the long term.