When it comes to growing your savings or investments, compounding interest is one of the most powerful forces in finance. Albert Einstein is even (possibly apocryphally) quoted as saying, “Compound interest is the eighth wonder of the world.” So, what is it, and how can you make it work for you?

What Is Compound Interest?

Compound interest is the interest you earn on both the money you invest (the principal) and the interest that accumulates over time. In other words, it’s “interest on interest.” Unlike simple interest, which only earns interest on the original principal, compound interest grows faster because your interest earns interest too.

The Formula (Don’t Worry, It’s Simple)

The general formula for compound interest is:

A = P(1 + r/n)ⁿᵗ

Where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial money).

- r is the annual interest rate (as a decimal).

- n is the number of times the interest is compounded per year.

- t is the time the money is invested or borrowed for, in years.

Now, let’s make that come to life with examples.

Example 1: The Power of Starting Early

Let’s say Jane invests €1,000 at an annual interest rate of 5%, compounded once per year. She leaves it untouched for 20 years.

Using the formula: A = 1000(1 + 0.05/1)^(1×20) = 1000(1.05)^20 ≈ €2,653.30

Even though Jane only invested €1,000, her investment more than doubled thanks to compound interest.

Example 2: Comparing Simple vs Compound Interest

Let’s compare:

- Simple Interest: €1,000 at 5% for 10 years → Interest = P × r × t = 1000 × 0.05 × 10 = €500

- Total = €1,500

- Compound Interest (annually): A = 1000(1.05)^10 ≈ €1,628.89

So with compounding, Jane earns €128.89 more over the same period. The longer the time, the bigger the difference.

Example 3: Monthly Compounding Magic

Let’s say John puts €5,000 into a savings account with an interest rate of 6%, compounded monthly for 10 years.

- P = 5,000

- r = 0.06

- n = 12

- t = 10

A = 5000(1 + 0.06/12)^(12×10)

A ≈ 5000(1.005)^120 ≈ €9,112.19

That’s over €4,000 in interest just by letting the money sit there!

How Your Investment with Southern Cross Compounds

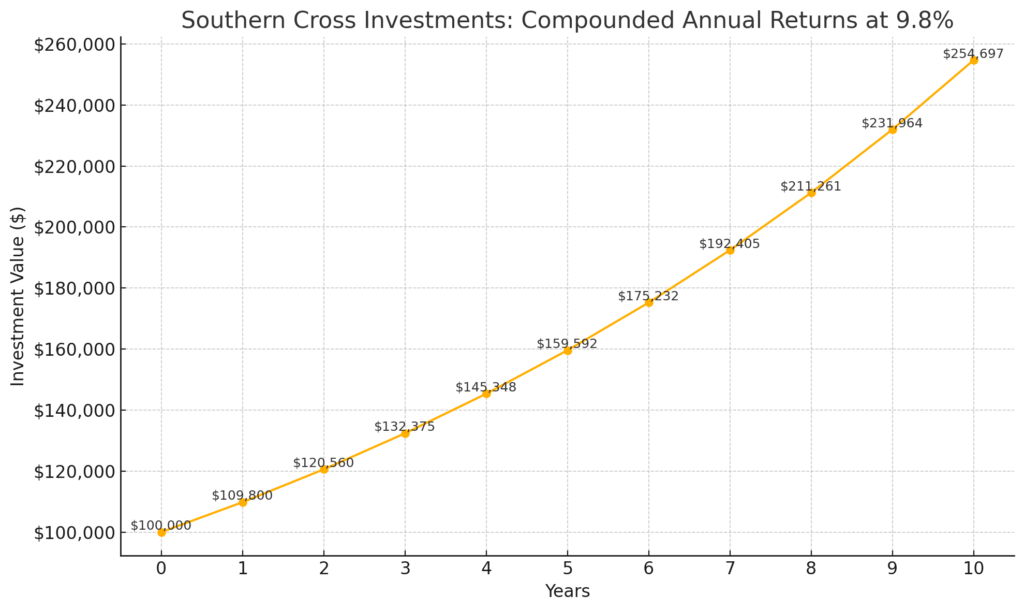

An initial $100,000 investment in Southern Cross Investments grows at a 9.8% annual return, compounding monthly, over 10 years. The power of compounding becomes very clear as your returns compound with time.

Key Takeaways

- Start Early: Time is your biggest ally. The earlier you start investing or saving, the more you benefit from compounding.

- Let It Grow: The longer you leave your money untouched, the more exponential the growth.

- Compound Frequency Matters: Monthly or daily compounding adds up faster than annual compounding.

Final Thought

Whether you’re saving for a rainy day, retirement, or a dream vacation, compound interest rewards patience. It’s like planting a tree—tiny at first, but mighty over time.

So next time you think about dipping into your savings early, remember: the real magic happens when you let your money work for you.